44 coupon rate and yield

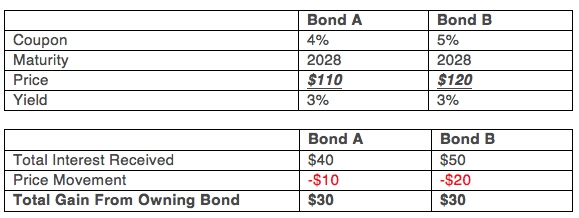

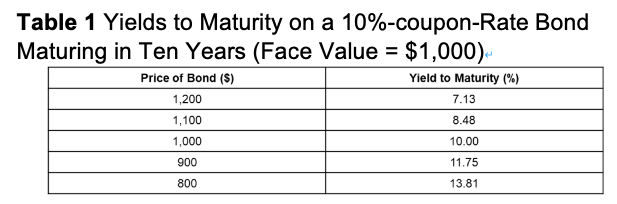

Coupon Interest and Yield for eTBs | australiangovernmentbonds Yield to Maturity is the rate of return on a bond (expressed as an annual rate) if purchased at the current market price and held until the Maturity Date. The calculation of the yield assumes all Coupon Interest Payments are reinvested at the same rate. Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Coupon vs Yield | Top 5 Differences (with Infographics) Key Differences. For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield Calculation Of The Yield The Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond's settlement value, maturity, rate, price, and ...

Coupon rate and yield

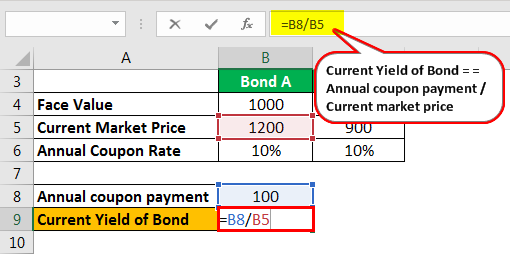

Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As we said above, the coupon rate is the product of the division of the annual coupon payment by the face value of the bond.It merely represents your annual return from your bond investments and does not tell you anything about the actual return of your investments.. On the other hand, the yield to maturity (YTM) represents the internal rate of return of your bond … Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield … Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (89 / 1000) * 100; Coupon Rate= 8.9%; For Unsecured NCDs. Coupon Rate = (91 / 1000) * 100; Coupon Rate= 9.1%; As we know, an investor expects a higher return for investing in a higher risk asset. Hence, as we could witness in the above example, unsecured NCD of Tata Capital fetches higher return compared to secured NCD. Explanation

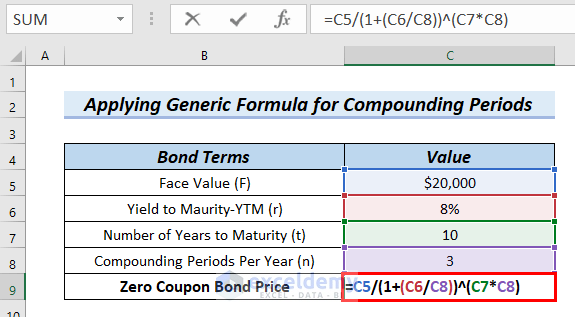

Coupon rate and yield. Bootstrapping | How to Construct a Zero Coupon Yield Curve in … Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. One must correctly look at the market conventions for proper calculation of the zero ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ... Current yield - Wikipedia Example. The current yield of a bond with a face value (F) of $100 and a coupon rate (r) of 5.00% that is selling at $95.00 (clean; not including accrued interest) (P) is calculated as follows. = = $ % $ = $ $ = % Shortcomings of current yield. The current yield refers only to the yield of the bond at the current moment. Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (89 / 1000) * 100; Coupon Rate= 8.9%; For Unsecured NCDs. Coupon Rate = (91 / 1000) * 100; Coupon Rate= 9.1%; As we know, an investor expects a higher return for investing in a higher risk asset. Hence, as we could witness in the above example, unsecured NCD of Tata Capital fetches higher return compared to secured NCD. Explanation Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield … Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As we said above, the coupon rate is the product of the division of the annual coupon payment by the face value of the bond.It merely represents your annual return from your bond investments and does not tell you anything about the actual return of your investments.. On the other hand, the yield to maturity (YTM) represents the internal rate of return of your bond …

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

![Coupon Rate: Formula and Bond Yield Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/10222811/Coupon-Rate-Formula-960x300.jpg)

![Bond Yield: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/11180917/Bond-Yield-Metrics-e1644621656277.jpg)

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "44 coupon rate and yield"