41 valuing zero coupon bonds

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are commonly issued by governments. In this article, we will have a closer look at the pros and cons of zero-coupon bonds from an investor's point of view: Pros of Zero-Coupon Bonds. There are many zero-coupon bonds that are already in existence. Also, each year, many new zero-coupon bonds are issued. Despite there being so ... Zero Coupon Bond Value Formula - Crunch Numbers Price of the zero-coupon bond is calculated much easier than a coupon bond price since there are no coupon payments. It is calculated as: P = \frac {M} { (1 + r)^ {n}} P = (1+r)nM. Where P is the current price of a bond, M is the face or nominal value, r is the required rate of interest, n is the number of years until maturity.

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... The price of zero-coupon bonds is calculated using the formula given below: See also What Is a Corporate Bond, and How Does It Work? Price = M / (1 + r) ^ n, where M = maturity value of the bond. (In other words, the face value of the bond) R = required rate of return (or interest rate) N = number of years till maturity

Valuing zero coupon bonds

Numerical Example in Valuing Zero coupon Bonds - New York … For example, the value of a zero coupon bond will increase from $385.00 to $620.92 as the bond moves from 10 years to maturity to 5 years to maturity assuming interest rates remain at … Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator 24/03/2021 · The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price … How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ...

Valuing zero coupon bonds. Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, … Zero Coupon Bond Value Calculator: Calculate Price, Yield … Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. … Valuing Bonds | Boundless Accounting | | Course Hero zero-coupon bond: A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. "Beat Back the Hun with Liberty Bonds" : After war was declared, the moral imperative of liberty and the Allied cause was touted in official ... Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) › an › enBond valuation and bond yields | P4 Advanced Financial ... The plain vanilla bond with annual coupon payments in the above example is the simpler type of bond. In addition to the plain vanilla bond, candidates – as part of their Advanced Financial Management studies and exam – are required to have knowledge of, and be able to deal with, more complicated bonds such as: bonds with coupon payments occurring more frequently than once a year ... › learn › finance-fundamentalsFundamentals of Finance | Coursera From valuing claims and making financing decisions, to elements of a basic financial model, the coursework provides a solid foundation to corporate finance. The specialization then moves to financial accounting, enabling learners to read financial statements and to understand the language and grammar of accounting. › en › membershipPricing of Swaps, Futures, & Forward Contracts | CFA Institute With a basic understanding of pricing and valuing a simple interest rate swap, it is a straightforward extension to pricing and valuing currency swaps and equity swaps. The solution for each of the three variables, one notional amount (NA a ) and two fixed rates (one for each currency, a and b), needed to price a fixed-for-fixed currency swap are :

Zero-Coupon Bond Definition - Investopedia If the debtor accepts this offer, the bond will be sold to the investor at $20,991 / $25,000 = 84% of the face value. Upon maturity, the investor gains $25,000 - $20,991 = $4,009, which translates... Valuing Zero-Coupon Bonds A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. Example A … Solved 2. Valuing a Zero-Coupon Bond. Assume the following | Chegg.com Question: 2. Valuing a Zero-Coupon Bond. Assume the following information for existing zero-coupon bonds: Par value = $100,000 Maturity = 3 years Required rate of return by investors = 12% How much should investors be willing to pay for these bonds? ANSWER: PV of Bond = PV of Coupon Payments + PV of Principal $0 + 100,000 (PVIF-12% -3 ... Zero-Coupon Bond: Formula and Calculator [Excel … To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the …

Zero Coupon Bond - Explained - The Business Professor, LLC

Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero Coupon Bonds Explained (With Examples) - Fervent Valuing Zero Coupon Bonds on Excel® We'll be using Excel's "PRICE" function to value Swindon Plc's bond. The first thing you want to do is setup your spreadsheet with a pro-forma / template that consists of the all different variables you'll need. The "PRICE" function on Excel® requires:

Zero Coupon Bonds Explained (With Examples) - Fervent 13/01/2021 · Zero Coupon Bonds, aka “Deep Discount Bonds”, or “ZCBs” are bonds (a type of debt instrument) that don’t pay any coupons (aka interest). In other words, there is no coupon …

Zero-Coupon Bond - Definition, How It Works, Formula

› expert › bond-spreadsWhat are bond spreads? - Financial Pipeline Feb 19, 2016 · The yield spread or “curve spread ” between these two bonds is 1.6%, which reflects the interest rate between the two bonds and the conditions of monetary policy. Coupon Spreads are spreads that reflect the differences between bonds with different interest rate coupons. For example, the Government of Canada has issued two bonds that are due ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia General Advantages of Zero-Coupon Bonds Why would anyone want a bond without the interest? Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For example, a $20,000...

Zero - Coupon Bonds - Economy Blatt Zero - coupon bonds are also called pure discount bonds as they trade at a discount, a price lower than the face value prior to its maturity date. Suppose you have purchased a one - year, risk - free, zero coupon bond which has an initial price of $ 144,927. The face value of the bond is $150,000.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting This zero-coupon bond was sold for $2,200 below face value to provide interest to the buyer. Payment will be made in two years. The straight-line method simply recognizes interest of $1,100 per year ($2,200/2 years). Figure 14.11 December 31, Years One and Two—Interest on Zero-Coupon Bond at 6 Percent Rate—Straight-Line Method

Example valuing a zero coupon bond compute the value The bond values corresponding to required yields of 3%, 6%, and 12% as the bond approaches maturity are presented in Figure 1. The change in value associated with the passage of time for the three bonds represented in Figure 1 is presented graphically in Figure 2. ©20 12 Kaplan, Inc. Page 91

Zero-Coupon Bond Definition - Investopedia

Zero-Coupon Bond: Formula and Calculator [Excel Template] To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

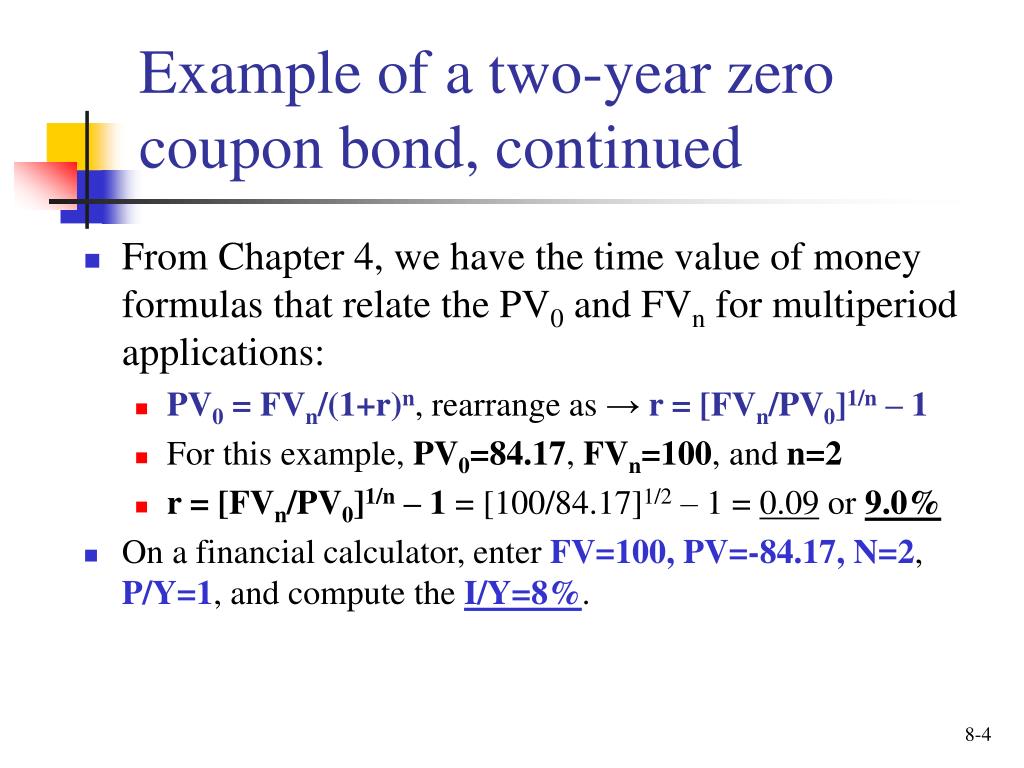

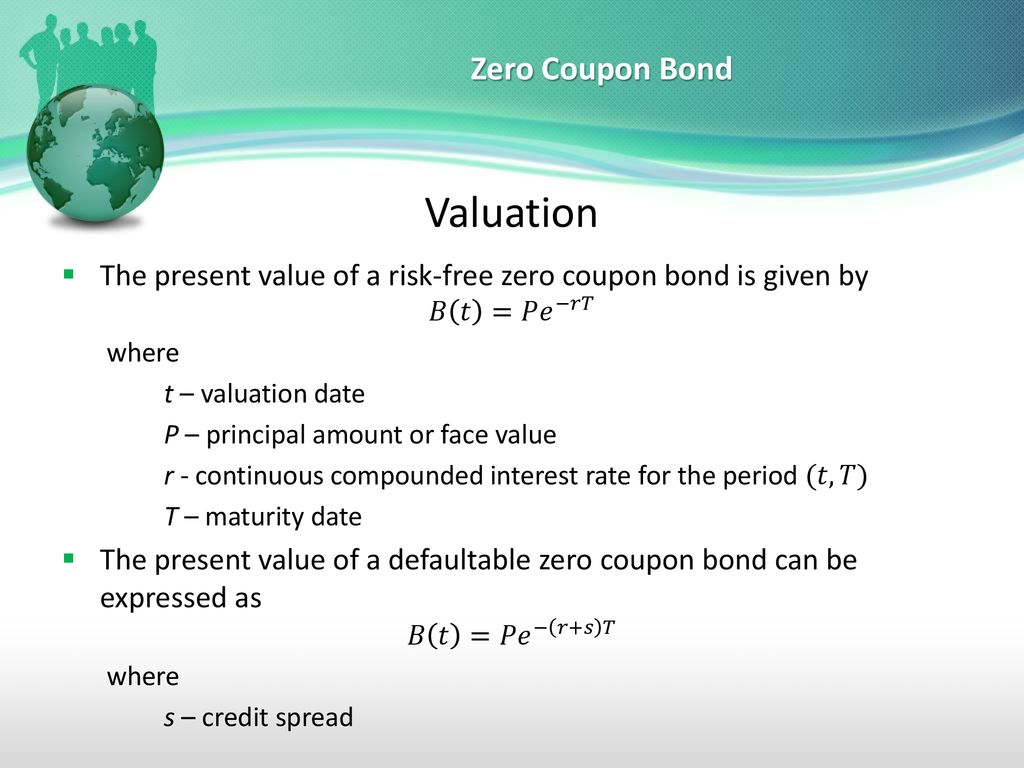

Valuing a zero-coupon bond | Mastering Python for Finance - Packt Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, y is the annually-compounded yield or rate of the bond, and t is the time remaining to the maturity of the bond. Let's take a look at an example of a five-year zero-coupon bond with a face value of $ 100. The yield is 5%, compounded annually.

› what-are-bonds-and-howWhat Are Bonds and How Do They Work? - The Balance Jul 03, 2022 · Zero-coupon bonds: Bonds that do not pay interest during the life of the bonds. Instead, investors buy zero-coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond matures. Convertible bonds: Can be converted into a different security—typically shares of the same company's common ...

Zero – Coupon Bonds – Economy Blatt 05/07/2019 · Zero – coupon bonds are also called pure discount bonds as they trade at a discount, a price lower than the face value prior to its maturity date. Suppose you have …

How Do Zero Coupon Bonds Work? - SmartAsset What Is a Zero Coupon Bond? A zero coupon bond is a type of bond that trades at a deep discount and doesn't pay interest. While some bonds start out as zero coupon bonds, others are can get transformed into them if a financial institution removes their coupons. When the bond reaches maturity, you'll get the par value (or face value) of the ...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The zero-coupon bond value refers to the current value of a zero-coupon bond. This formula requires three variables: face value, interest rate and the number of years to maturity. The zero-coupon bond value is usually expressed as a monetary amount. This equation is sensitive to interest rate fluctuations.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ...

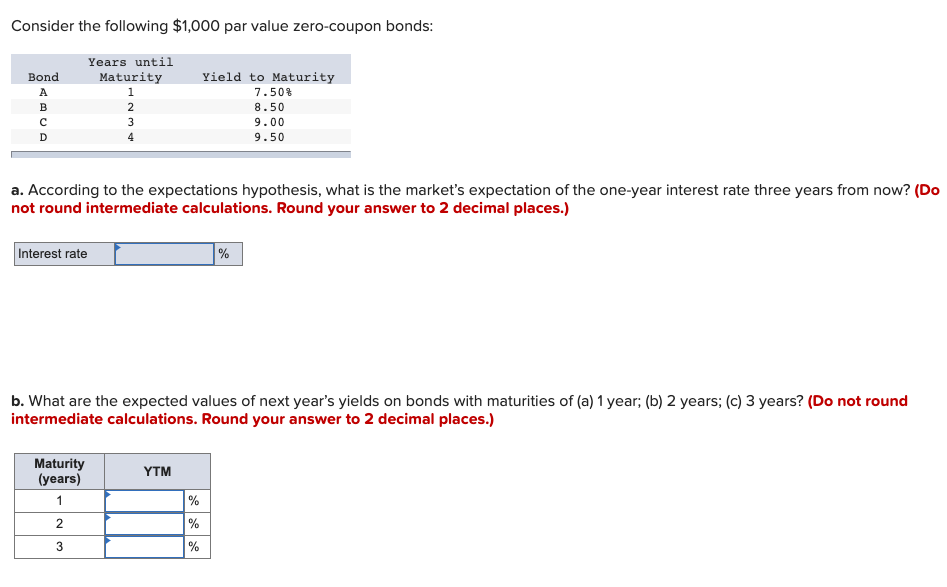

PDF Numerical Example in Valuing Zero coupon Bonds - New York University For example, the value of a zero coupon bond will increase from $385.00 to $620.92 as the bond moves from 10 years to maturity to 5 years to maturity assuming interest rates remain at 10%. 4) Compare the value of the zero at 10 years to maturity when rates are 10% versus when they are 7%. Lower interest rates mean higher bond prices.

quizlet.com › 517145219 › sophia-pathways-principlesSOPHIA PATHWAYS Principles of Finance unit 2 - Quizlet b.)Longer-term bonds are less sensitive to interest rate risk than shorter-term bonds. c.)Bonds held until maturity have greater exposure to interest rate risk. d.)It stems from the fact that coupon rates and market interest rates are directly correlated.

Zero Coupon Bond Calculator - What is the Market Value? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds

efinancemanagement.com › sources-of-finance › bondsAll the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor.

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US ...

Zero Coupon Bond: Formula & Examples - Study.com The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value yearly until maturity). Rather, zero-coupon bonds...

How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ...

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator 24/03/2021 · The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price …

Numerical Example in Valuing Zero coupon Bonds - New York … For example, the value of a zero coupon bond will increase from $385.00 to $620.92 as the bond moves from 10 years to maturity to 5 years to maturity assuming interest rates remain at …

![Zero-Coupon Bond: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/08135541/Zero-Coupon-Bond-Calculator.jpg)

![Zero-Coupon Bond: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/28183250/Zero-Coupon-Bonds-Formula.jpg)

Post a Comment for "41 valuing zero coupon bonds"