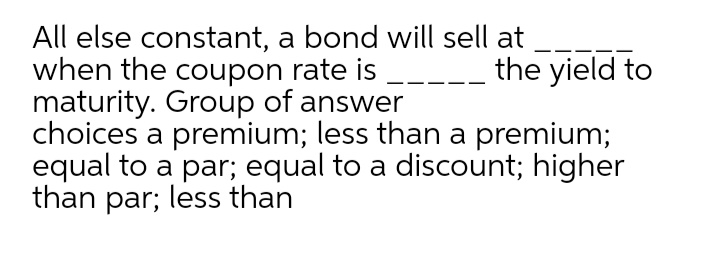

45 coupon rate and yield to maturity

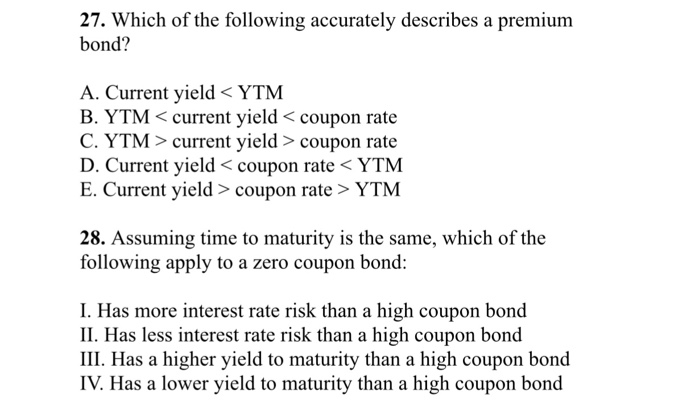

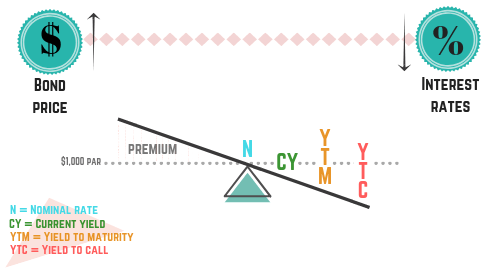

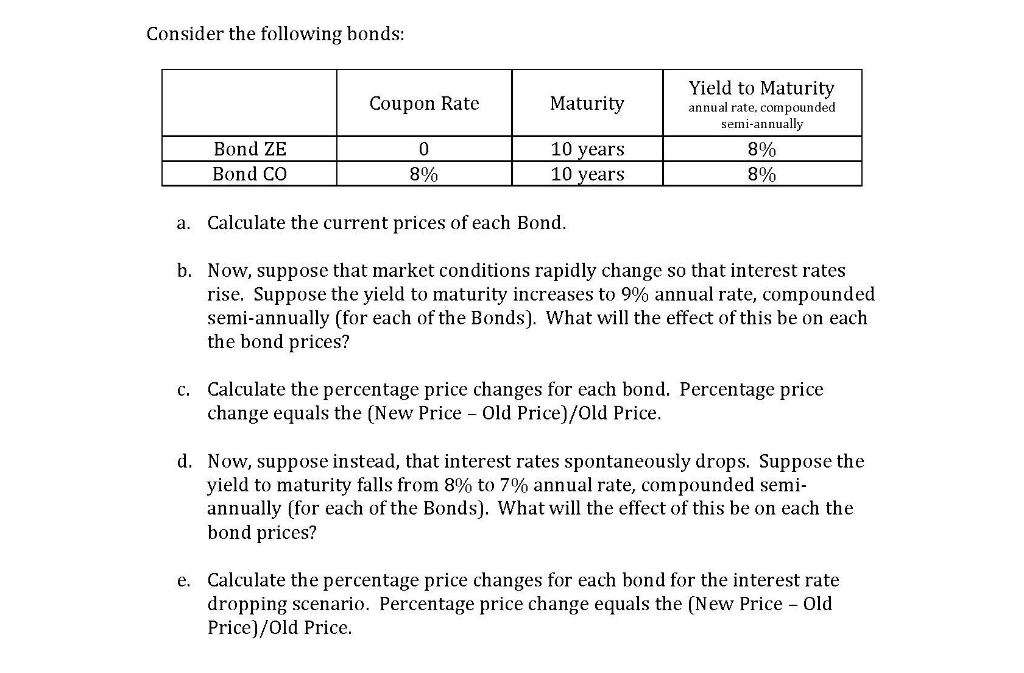

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... Concept 82: Relationships among a Bond’s Price, Coupon Rate ... Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate. A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. A bond is priced at a discount below par value when the coupon rate is less than the market discount rate.

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value .

Coupon rate and yield to maturity

Coupon Rate Definition - Investopedia 28.05.2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Yield to Maturity – YTM vs. Spot Rate. What's the Difference? Jan 23, 2022 · A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an average interest rate until the bond ... Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A yield to maturity calculation assumes that all the coupon payments are reinvested at the yield to maturity rate. This is highly unlikely because future rates can't be predicted.

Coupon rate and yield to maturity. Coupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A yield to maturity calculation assumes that all the coupon payments are reinvested at the yield to maturity rate. This is highly unlikely because future rates can't be predicted. Yield to Maturity – YTM vs. Spot Rate. What's the Difference? Jan 23, 2022 · A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an average interest rate until the bond ...

Coupon Rate Definition - Investopedia 28.05.2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

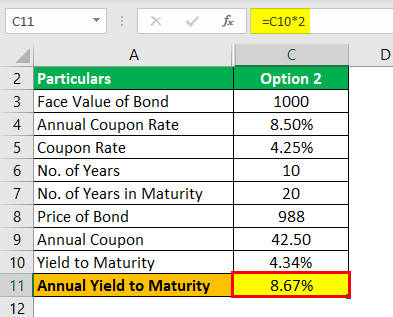

Write down the formula that is used to calculate the yield to maturity on a twenty-year 12 % coupon bond with a 1,000 face value that sells for 2,500.

:max_bytes(150000):strip_icc()/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

Post a Comment for "45 coupon rate and yield to maturity"