39 relationship between coupon rate and ytm

Assignment on Bonds - Allessaytyper Explain the difference between the coupon rate and the required rate of return on the bond. (250-225 words, or 2-3 paragraphs) Explain why some bonds sell at a premium over their par value while other bonds sell at a discount. Also discuss the relationship between the coupon rate and the YTM for premium bonds. Bond Yield Formula | Step by Step Calculation & Examples Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we have to understand that this calculation completely depends on annual coupon and bond price. It completely ignores the time ...

Coupon Rate Calculator | Bond Coupon 12/01/2022 · As we said above, the coupon rate is the product of the division of the annual coupon payment by the face value of the bond.It merely represents your annual return from your bond investments and does not tell you anything about the actual return of your investments.. On the other hand, the yield to maturity (YTM) represents the internal rate of return of your bond …

Relationship between coupon rate and ytm

Yield to Maturity - What it is, Use, & Formula - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is held to maturity. There are two formulas for yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [ (Face Value / Current Value) (1 / time periods)] -1. The yield to maturity formula for a ... Why Do Bond Prices and Yields Move in Opposite Directions? Here's how the math works: Bond A has an original price of $1,000 with a coupon payment of 4%, and its initial yield to maturity is 4%. In other words, it pays out $40 of interest each year. Because the coupon or interest rate always stays the same, Bond A's price must fall to $900 to keep its yield the same as Bond B. How to calculate Spot Rates, Forward Rates & YTM in EXCEL 31/01/2012 · 3 mins read a. How to determine Forward Rates from Spot Rates. The relationship between spot and forward rates is given by the following equation: f t-1, 1 =(1+s t) t ÷ (1+s t-1) t-1-1. Where. s t is the t-period spot rate. f t-1,t is the forward rate applicable for the period (t-1,t). If the 1-year spot rate is 11.67% and the 2-year spot rate is 12% then the forward rate applicable …

Relationship between coupon rate and ytm. YTM - BrainMass 8) Yield to maturity The Salem Company bond currently sells for $ 955, has a 12% coupon interest rate and a $ 1,000 par value, pays interest annually, and has 15 years to maturity. a. Calculate the yield to maturity ( YTM) on this bond. b. Explain the relationship that exists between the coupon interest rate and yield to maturity and the par ... Relation Between Bond Price and Yield – Risk and Return 04/10/2016 · The relation between bond price and Yield to maturity (YTM) YTM is the total return anticipated on a bond if the bond is held until its lifetime. It is considered as a long-term bond yield but is expressed as an annual rate. Basically, YTM is the internal rate of return of an investment in the bond if the following two conditions are satisfied: The Difference Between Interest Rate & Yield to Maturity A loan's interest rate is the rate a lender receives on an annual basis until a loan is repaid. When it relates to consumer lending, the interest rate is expressed as the loan's annual percentage rate (APR). For instance, assume a bank grants a one-year loan of $1,000, for which the bank will earn 10 percent simple interest. Current yield - Wikipedia Relationship between yield to maturity and coupon rate. The concept of current yield is closely related to other bond concepts, including yield to maturity (YTM), and coupon yield. When a coupon-bearing bond sells at; a discount: YTM > current yield > coupon yield; a premium: coupon yield > current yield > YTM

Coupon Rate - Meaning, Calculation and Importance - Scripbox The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. Let's assume the couponrate for a bond is 15%. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Bond Pricing - Formula, How to Calculate a Bond's Price A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. Spot Rates and Forward Rates - CFA, FRM, and Actuarial Exams Study Notes The yield to maturity (YTM) is the discount rate that equates the present value of future bond payments (includes coupons and the par value) to the bond's market price. In other words, YTM is the expected rate of return on a bond if: The bond is held to maturity. The bold does not default.

Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security. ... On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like ... Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the coupon rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and coupon rate is 2.375%. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. Basis Point Value - Overview, Bond Yields and Prices The par value of the bond must also be repaid by the issuer on the date of maturity. Therefore, bond yield can be calculated by dividing the total coupon payments by the face value of the bond. Yield to Maturity (YTM) However, simply using coupon rates and face value is an incomplete calculation of total bond yield.

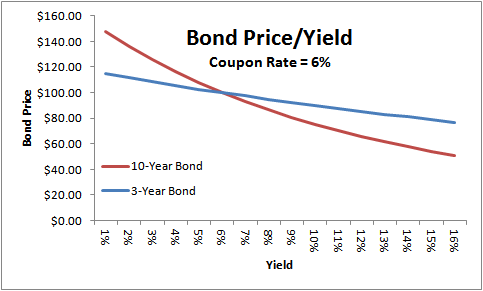

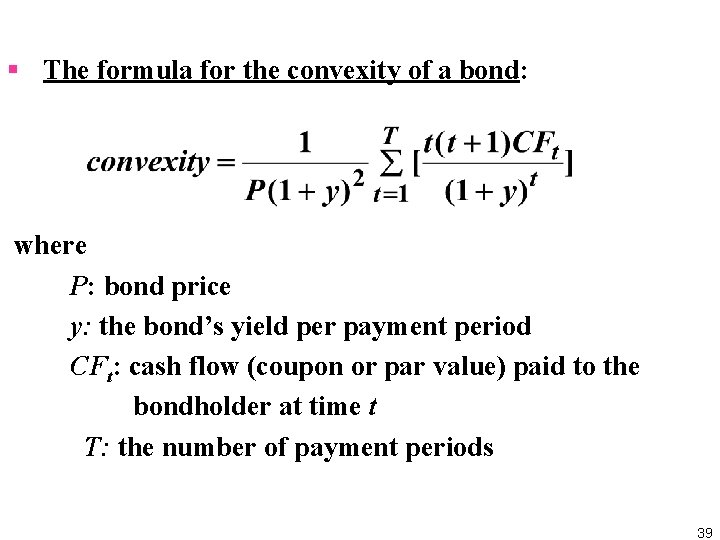

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Annual Coupon Rate (%) - The annual interest rate paid on the bond's face value. ... The above graph shows the relationship for price and yield using the default values in the tool. Note the following outputs: Current YtM: Computed current yield to maturity; Current Price: Current bond trading price; X-Axis: Plus and minus 3% changes in market yield; Y-Axis: Estimated price …

Explain why the coupon rate and the yield to maturity determine why the ... •Explain the relationship observed between ratings and yield to maturity. •Explain why the coupon rate and the yield to maturity determine why the bonds would trade at a discount, premium, or par. •Based on the material you learn in this Phase, what would you expect to happen to the yield to maturity and market value of the bonds if the ...

› blog › relation-between-bondRelation Between Bond Price and Yield – Risk and Return Oct 04, 2016 · The relation between bond price and Yield to maturity (YTM) YTM is the total return anticipated on a bond if the bond is held until its lifetime. It is considered as a long-term bond yield but is expressed as an annual rate. Basically, YTM is the internal rate of return of an investment in the bond if the following two conditions are satisfied:

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jan 12, 2022 · On the other hand, the yield to maturity (YTM) represents the internal rate of return of your bond investments if you hold them until maturity, and so provides a more holistic picture of your return. The relationship between coupon rates and market interest rates

Duration: Interest Rate Sensitivity - CredAvenue To recap, the relationship between bond price and Yield to Maturity (YTM) is inverse. Source: CredAvenue Research . In the case of a downward interest rate scenario, bonds issued earlier would have a higher coupon rate than the current market rates.

Yield To Maturity Calculation Using a Python Script When interested in buying bonds a term that often comes up is the definition of Yield To Maturity (YTM). Lucas L. Software Engineer. ... Solving the equation by hand requires an understanding of the relationship between a bond's price and its yield, as well as of the different types of bond pricings. ... (" \n ") ytm = coupon_rate condition ...

Yield to Maturity vs. Coupon Rate: What's the Difference? 20/05/2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It …

Yield To Maturity of the Bond - BrainMass Bond D $1,000 Coupon interest rate 15% Years to maturity 10 Current Value $1,120 Bond E $1,000 Coupon interest rate 5% Years to maturity 3 Current Value $900. a. Calculate the yield to maturity (YTM) for each bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond ...

Post a Comment for "39 relationship between coupon rate and ytm"